September 20th Update

Click Here for CFAP 2 Information

Click Here for Livestock

This information was presented by AgManager.info and Kansas State University Agricultural Economics

Direct Payments to Ag Producers

Coronavirus Food Assistance Program (CFAP)

Robin Reid, Extension Farm Economist, K-State Department of Ag. Economics

David Schemm, State Executive Director, Kansas Farm Service Agency

Todd Barrows, Agriculture Program Specialist, Kansas Farm Service Agency

Carla Wikoff, Agriculture Program Specialist, Kansas Farm Service Agency

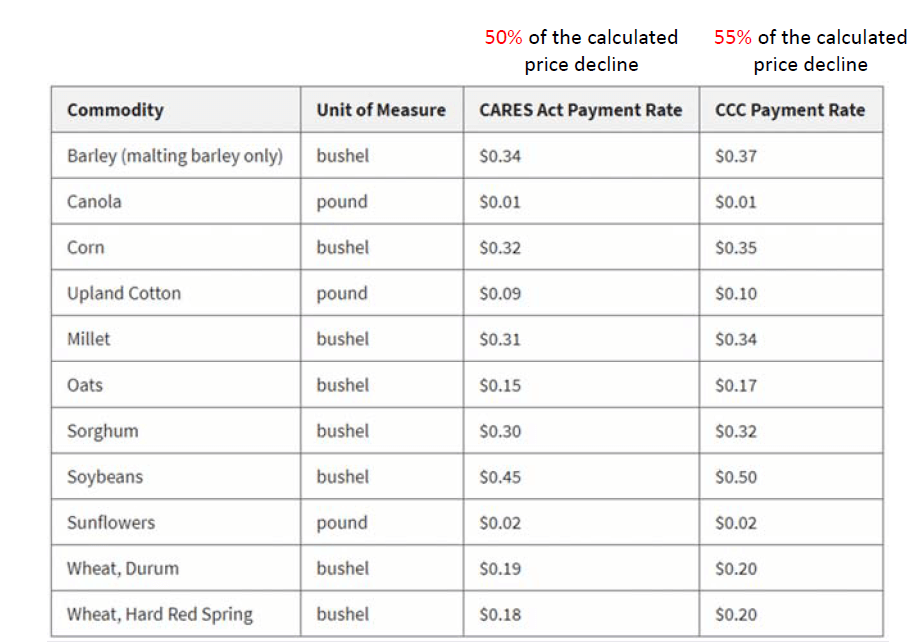

Two programs- One Payment

•CARES Act = $9.5 Billion

•CCC Charter Act = $6.5 Billion

Total $16 Billion

•CARES Act: to partially compensate producers for losses due to price declines that

occurred between mid-January 2020 and mid-April, 2020

•CCC: to partially compensate producers for $6.5 billion for on-going market disruptions

and will assist with the transition to a more orderly marketing system as the COVID-19

pandemic wanes

Timing of Payments

Only 80% of the total calculated payment will be made at this time

A final payment will be issued at a later date determined by the Secretary to the extent

that funds are available

Sign-up starts on May 26th, 2020 and ends August 28th, 2020

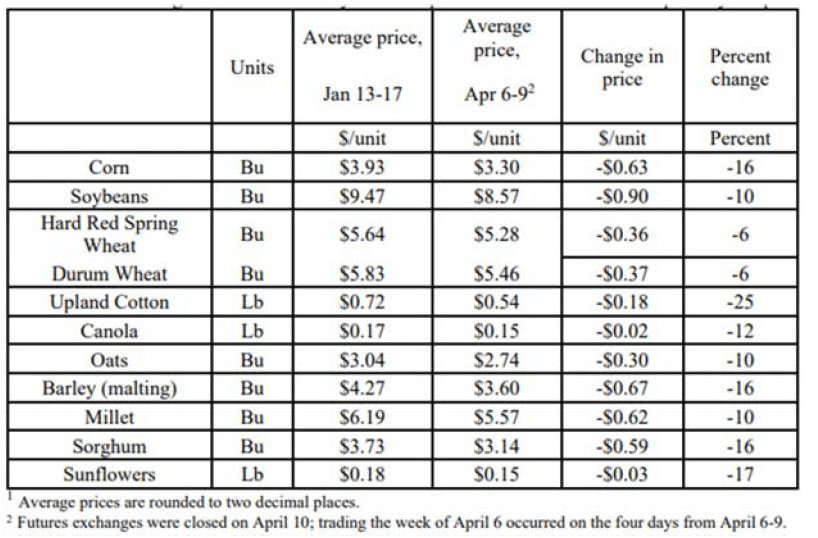

Non-Specialty Crops

• Malting barley, canola, corn, upland cotton, millet, oats, sorghum, soybeans,

sunflowers, durum wheat, and hard red spring wheat

• Loss was determined based on the decline in the weekly average futures price for

January 13th -17th compared to the average for the week of April 6th-9th

• If the loss was greater than 5%, then a payment was triggered

Non-Specialty Crops

• Producers will be paid based on unpriced inventory as of Jan. 15th, 2020, not to

exceed 50% of 2019 production

• Unpriced inventory means any production that is not subject to an agreed-upon price in the

future through a forward contract, agreement, or similar binding document.

• All production, sales, and inventory of eligible commodities and livestock must be subject to

price risk as of January 15, 2020. Unpriced inventory or production subject to price risk means

any production, sales, and inventory that is not subject to an agreed-upon price in the future

through a forward contract, agreement, or similar binding document. The producer’s eligible

commodity and/or livestock must still be at risk of price fluctuations after January 15, 2020, to

be eligible for payment.

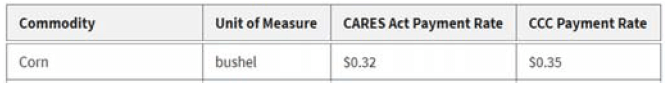

Example Payment-Corn

A producer had 10,000 bushels of unpriced corn in the elevator on Jan. 15th, 2020

5,000 bushels X $0.32 = $1,600

5,000 bushels X $0.35 = $1,750

Total $3,350

You can also think of it as adding the payment rates together ($0.32 + $0.35 = $0.67) and paying on 50% of

your inventory on Jan. 15th

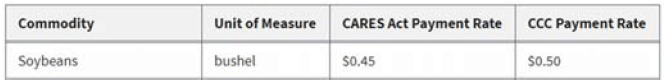

Example Payment-Soybeans

A producer had 10,000 bushels of unpriced soybeans in the elevator on Jan. 15th, 2020

5,000 bushels X $0.45 = $2,250

5,000 bushels X $0.50 = $2,500

Total - $4,750

You can also think of it as adding the payment rates together ($0.45 + $0.50 = $0.95) and paying on 50% of

your inventory on Jan. 15th

CFAP Eligibility

• “Producer” refers to a person or legal entity who shares in the risk of producing a crop

or livestock and who is entitled to a share in the crop or livestock available for

marketing.

•Ineligible for payment if average of the adjusted gross incomes for the 2016, 2017 and

2018 tax years, is more than $900,000 unless at least 75 percent of that person’s or legal

entity’s average AGI is derived from farming, ranching, or forestry-related activities

• Must comply with Highly Erodible Land and Wetland Conservation regulations

Payment Limitations

• Total CFAP payment may not exceed $250,000 for ALL commodities

combined

• The total amount of CFAP payments a direct payment corporation, limited liability

corporation, or a limited partnership may receive is $500,000 if two different individual

owners of the legal entity each provided at least 400 hours of active personal labor or

active personal management or combination thereof with respect to the production of

2019 commodities

• $750,000 if three different individual owners of the legal entity each provided at least 400

hours

To see full presentation click HERE